At home Banking

Iain MacLennan, Head of Trade & Supply Chain Finance at Finastra, explains why now is the time for truly digital commerce.

Global Finance: Are we ready for the end-to-end digitalization of commerce?

Iain MacLennan: Yes, the world is now ready for the end-to-end digitalization of trade finance and supply chains. We have been on the eve of this for several years.

We started the journey before the pandemic, saw an acceleration through the pandemic, and now we’ve seen further fundamental changes over the last six months to drive this forward.

One of these was the Electronic Commercial Documents Act, which allowed electronic commercial documents [treated the same as paper documents] from the end of September 2023 under English law.

Other countries, such as Germany, France, and the Netherlands, are moving forward with similar legislation. Another reason why we are ready now is due to the potential benefits of digitalization in terms of carbon emissions reductions and business and operational efficiencies, such as real-time data capabilities, process effectiveness, and so on.

The International Chamber of Commerce has stated that the digitalization of trade documents could generate up to £25 billion ($32 billion) in incremental growth this year, and up to £224 billion in efficiency savings.

female friend: What are the benefits and challenges of artificial intelligence in trade finance?

MacLennan: AI has been used for document compliance checking and fraud solutions within the trade finance industry for several years, and as AI develops, its use will increase within the trade finance industry as well.

To understand how I asked ChatGPT where this would benefit the trade finance industry.

The suggestions include expanding fraud detection and compliance management; removing manual processing by, for example, automating invoice or payment processing; insight into trade transactions and trade flows, as well as support for decision-making based on this; and customer and colleague support through knowledge and transaction management assistance.

There will be clear benefits from the continued development of AI in our business. However, there are potential challenges to AI, including data quality, cost, scalability, ethics, and repeatability.

female friend: How do partnerships drive trade finance solutions “as a service”?

MacLennan: We talk a lot about the trading ecosystem, which includes the physical movement of goods, the documentary flow, and the financial flows associated with the transaction.

Within this ecosystem, there are a significant number of participants and information providers. We are now seeing significant collaboration between the various participants, industry bodies, application suppliers, and others.

Several partnerships are also being built to address key systemic issues, although we need to take into account several challenges, especially in trade networks.

Networks are notoriously difficult, and I use the Lord of the Rings analogy: “There won’t be one network that rules them all.” Here interoperability is crucial. We’ve been talking about interoperability for several years, but this is now coming to the fore.

In the field of solutions as a service, we create extra value with our partners who operate as a service for our customers, allowing them to realize value from this relationship.

At Sibos, we presented our concept of a trade finance tool at IBM, where we see value in creating a trade finance package as a service that a client can engage with, without having to engage multiple partners.

female friend: How can technology help the trade finance sector prioritize environmental, social, and governance objectives?

MacLennan: Technology will enable the trade finance industry to meet the required ESG standards as they evolve, so it’s not a matter of prioritizing; it’s really about execution and standardization.

There are already various ESG solutions on the market. I work closely with an organization that provides automated ESG scoring.

This partner has aligned itself with frameworks such as the UN Sustainable Development Goals and the EU taxonomy and works with many financial institutions and other bodies to build its offering from a market perspective and not simply a ‘one bank view’.

This is where I think the trade finance industry has an edge over other parts of the financial industry, based on my conversations with colleagues.

Building frameworks, along with access to required data sources, will be critical to proving ESG compliance and addressing potential concerns about greenwashing.

Furthermore, the technology provides the ability to seamlessly update such scores based on material changes in input, meaning you get an up-to-date view of a transaction or counterparty based on current information.

Similar Topics

Is the UK GDP in Recession? How BOE is Responding to Inflation and Slowdown

Imagine yourself standing at the helm of a mighty ship, the UK economy. The once steady seas have become a…

How Forex Liquidity Providers Keep Markets Moving

Imagine a bustling marketplace buzzing with currency exchanges. Behind the scenes, silent heroes called Forex liquidity providers work tirelessly to…

Russell 2000 Technical Analysis

Yesterday, the Russell 2000 staged a strong rally, erasing all losses from the hot US CPI numbers. It appears the…

Statistics for Your Trade Magazine | Forex Tips for Analyzing Trades

In previous blogs, I emphasized the importance of recording transactions and highlighted the best journaling options. For new traders, efficient…

Never Miss a Good Trade | Forex Psychology

In the fast-paced realm of Forex trading, the Fear of Missing Out (FOMO) looms like a shadow, affecting not only…

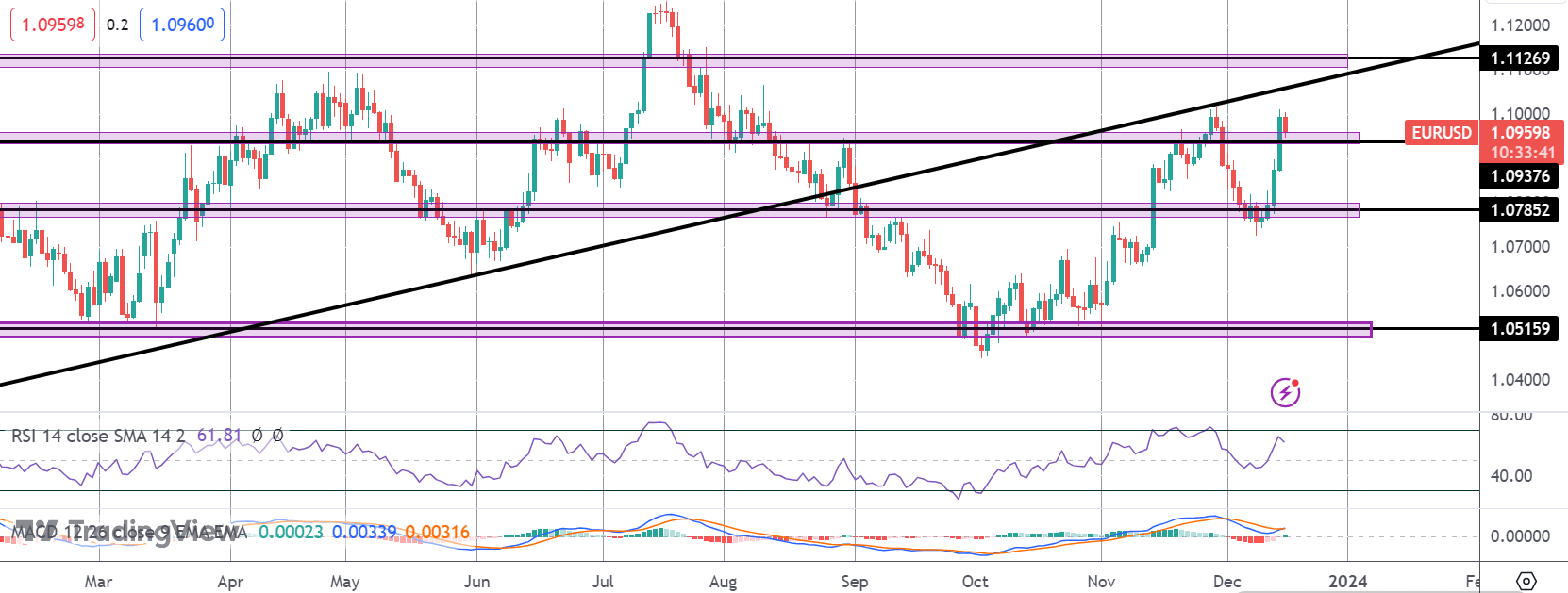

EURUSD Traders Caught Between Fed and ECB

EUR rally stalls Following the post-FOMC rally we saw on Wednesday, EURUSD was pushed further higher by the ECB yesterday. While…