Imagine yourself standing at the helm of a mighty ship, the UK economy. The once steady seas have become a churning vortex. The sails strain against powerful winds of inflation (UK CPI) and a weakening economy (UK GDP). In the distance, dark clouds of recession loom large.

To navigate this economic storm, you need a skilled crew and a captain with unwavering resolve. This captain is the Bank of England (BOE), tasked with steering the UK economy through these treacherous waters using the powerful tool of monetary policy, specifically interest rates.

Will the BOE raise the sails of interest rates to combat inflation, risking a stall in economic growth (recession)? Or will they keep the sails loose, potentially allowing inflation to run rampant?

This is the critical decision facing the BOE, a decision that will impact the lives of every citizen in the UK.

Understanding the UK’s Economic Tug-of-War

The UK economy finds itself in a precarious position, caught in a tug-of-war between rising inflation (UK CPI) and a potential recession (UK GDP). Let’s delve deeper into these two forces:

- UK GDP and the Grip of Recession: Gross Domestic Product (GDP) measures the total value of goods and services produced in the UK. After a promising start in 2023, the UK economy entered a technical recession in February 2024, marked by two consecutive quarters of negative GDP growth.

While the full-year 2023 figures showed a meager 0.1% increase, Q3 and Q4 2023 contracted by 0.1% and 0.3% respectively. This economic slowdown can be attributed to several factors:

- Global Supply Chain Disruptions: The COVID-19 pandemic continues to cast a long shadow, with ongoing disruptions in global supply chains impacting the availability and cost of goods imported into the UK.

- Rising Energy Prices: The war in Ukraine has caused a significant surge in energy prices, leading to higher costs for businesses and consumers alike. This not only impacts production but also reduces disposable income, further dampening economic activity.

- Labor Strikes: Discontent with rising living costs and stagnant wages has led to a wave of labor strikes across various sectors, further hindering production and economic output.

- Global Supply Chain Disruptions: The COVID-19 pandemic continues to cast a long shadow, with ongoing disruptions in global supply chains impacting the availability and cost of goods imported into the UK.

- UK CPI and the Sting of Inflation: The Consumer Price Index (CPI) measures the average change in prices of goods and services purchased by households. While a certain level of inflation is considered healthy for a growing economy, the UK is facing a situation where CPI has risen above the Bank of England’s target of 2%.

This persistent inflation erodes purchasing power, meaning that people can buy less with the same amount of money. Here’s how inflation stings:

- Higher Cost of Living: The rising cost of essentials like food, energy, and transportation significantly impacts household budgets. As families struggle to make ends meet, discretionary spending gets cut back, further stifling economic activity.

- Wage Stagnation: Wages haven’t kept pace with inflation, leading to a decline in real incomes. This reduces consumer confidence and further weakens economic demand.

- Business Uncertainty: Inflation creates uncertainty for businesses, making it difficult to plan for future costs and investments. This hesitation to invest can further dampen economic growth.

- Higher Cost of Living: The rising cost of essentials like food, energy, and transportation significantly impacts household budgets. As families struggle to make ends meet, discretionary spending gets cut back, further stifling economic activity.

The BOE’s Balancing Act: Monetary Policy in Focus

The Bank of England (BOE) is tasked with maintaining price stability and promoting maximum sustainable employment in the UK. To achieve this dual mandate, the BOE utilizes various monetary policy tools, the most prominent of which is interest rates. However, in the current economic climate, the BOE faces a delicate balancing act:

- Raising Interest Rates to Curb Inflation: Raising interest rates makes borrowing more expensive for businesses and consumers. This discourages borrowing and investment, thereby dampening economic activity and ultimately leading to lower inflation. However, raising rates too aggressively could push the economy further into recession.

- Keeping Rates Low to Stimulate Growth: Keeping interest rates low encourages borrowing and investment, which can stimulate economic growth. However, this approach risks allowing inflation to spiral out of control, further eroding purchasing power and destabilizing the economy.

Real-world Examples: The Impact on Businesses and Consumers

The tug-of-war between inflation and recession has real-world consequences for businesses and consumers:

- Businesses: Imagine a small manufacturing company struggling with rising costs for raw materials and energy due to inflation. If the BOE raises interest rates to combat inflation, it will become even more expensive for the company to borrow money for expansion or investment. This could lead to production cuts, layoffs, and ultimately hinder economic growth.

- Consumers: John, a single father of two, is already feeling the pinch of inflation. His grocery bills have skyrocketed, and his energy costs have doubled. A potential BOE rate hike could further tighten his budget.

Reduced disposable income means John might have to forgo non-essential purchases like new clothes for his children or entertainment subscriptions. This decline in consumer spending will negatively impact businesses that rely on discretionary spending.

BOE’s Recent Actions and Future Outlook

The BOE has already taken steps to address the UK’s economic challenges. In 2023, they implemented a series of interest rate hikes, aiming to curb inflation. These hikes have had a mixed impact:

- Modest Impact on Inflation: While the recent rate hikes might have helped slow the pace of inflation slightly, CPI remains above the 2% target. Further hikes might be necessary to bring inflation under control.

- Early Signs of Economic Slowdown: The economic slowdown witnessed in Q3 and Q4 of 2023 could be partly attributed to the BOE’s tightening monetary policy. This raises concerns about the potential for a deeper recession if interest rates are raised further.

Looking ahead, the BOE’s future actions will depend on several factors:

- Inflation Trajectory: The BOE will closely monitor inflation data. If inflation shows signs of peaking or declining, the BOE might pause or even consider rate cuts to stimulate growth.

- Strength of the Labor Market: A strong labor market with low unemployment could support the BOE’s case for further rate hikes to combat inflation. Conversely, a weakening labor market with rising unemployment might prompt the BOE to prioritize economic growth over inflation control.

- Global Economic Conditions: The global economic climate will also play a role. A slowdown in the global economy could further weaken the UK’s economic outlook, influencing the BOE’s decisions.

Navigating the Uncertain Path: The Role of Businesses and Consumers

While the BOE plays a crucial role in managing the UK’s economic climate, businesses and consumers also have a part to play in navigating this uncertain path:

- Businesses: Businesses can adopt cost-saving measures to improve efficiency and manage rising costs. Additionally, offering competitive wages and benefits can help retain talent and boost employee morale during challenging times.

- Consumers: Consumers can become more cost-conscious by creating budgets, comparing prices, and seeking out deals. Additionally, supporting local businesses can help strengthen the local economy.

Conclusion

The UK’s economic tug-of-war between inflation and recession necessitates a coordinated effort from the BOE, businesses, and consumers. By carefully considering the data and making informed decisions, the BOE can guide the economy through this challenging period. Businesses can adapt and innovate to navigate rising costs and a potential slowdown.

Finally, consumers can make informed choices to manage their finances and support the local economy. Through a collaborative effort, the UK can weather this economic storm and emerge stronger on the other side.

Similar Topics

How Forex Liquidity Providers Keep Markets Moving

Imagine a bustling marketplace buzzing with currency exchanges. Behind the scenes, silent heroes called Forex liquidity providers work tirelessly to…

Russell 2000 Technical Analysis

Yesterday, the Russell 2000 staged a strong rally, erasing all losses from the hot US CPI numbers. It appears the…

Statistics for Your Trade Magazine | Forex Tips for Analyzing Trades

In previous blogs, I emphasized the importance of recording transactions and highlighted the best journaling options. For new traders, efficient…

Never Miss a Good Trade | Forex Psychology

In the fast-paced realm of Forex trading, the Fear of Missing Out (FOMO) looms like a shadow, affecting not only…

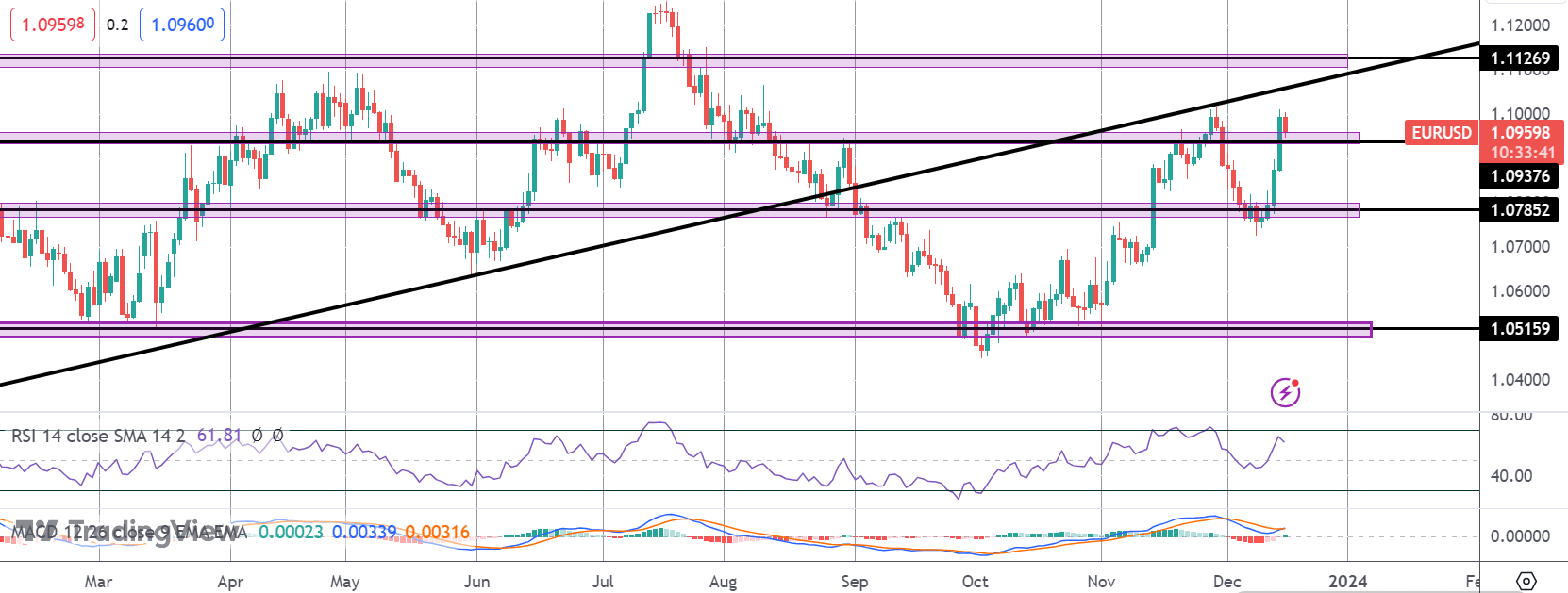

EURUSD Traders Caught Between Fed and ECB

EUR rally stalls Following the post-FOMC rally we saw on Wednesday, EURUSD was pushed further higher by the ECB yesterday. While…

Moderate Optimism, an Eye for Risks: Navigating the Financial Landscape in 2024

The dawn of a new year brings a mixed bag of challenges and opportunities. Despite renewed geopolitical tensions and wars,…