In the fast-paced realm of Forex trading, the Fear of Missing Out (FOMO) looms like a shadow, affecting not only novice traders but also seasoned veterans.

The anxiety of missing potentially lucrative trades can lead to impulsive decisions, transforming Forex trading into a more stressful endeavor than necessary.

To navigate this psychological challenge, we’ve compiled essential tips to ensure you never miss out on a good trade.

Set Up Import Orders for Precision

One effective strategy to combat FOMO is the utilization of entry orders.

These pending orders allow traders to set specific price points for trade execution, automating the process when the market hits the defined levels.

By placing entry orders strategically, you can enter trades even when you’re not actively monitoring the charts.

Additionally, incorporating stop-loss levels within these orders safeguards your risk management, providing a layer of protection during periods of inactivity.

Leverage Signals and Warnings for Timely Action

Harness the power of technology by setting up price alerts on your trading platform.

These alerts act as timely notifications, ensuring you’re informed when the market reaches critical levels. Another valuable approach is to subscribe to reliable Forex signal services.

These services provide expert insights, helping you distinguish between favorable and unfavorable trading opportunities.

By combining technology-driven alerts with professional signals, you empower yourself with comprehensive information for well-informed decision-making.

Take Calculated Risks for Strategic Trading

When hesitancy arises due to perceived high risks, consider scaling down your position size.

Instead of risking a significant percentage of your capital, opt for a smaller position – perhaps 1% rather than 5%.

This allows you to test the waters while maintaining risk management principles.

Before implementing this strategy, take a moment for thoughtful consideration.

Balancing risk and safe trading through reduced position sizes is a prudent approach to navigate uncertain market conditions.

Focus on Balance, Not Just Wins or Losses

In the dynamic world of Forex, it’s crucial to shift your focus from the quantity of trades to the overall balance of your account.

Particularly for scalpers accustomed to frequent daily trades, resist the urge to impulsively match your standard number of trades.

Instead, assess the performance based on your account’s overall profitability.

A successful trading day should be gauged by the positive trajectory of your account, emphasizing the significance of a holistic, long-term perspective over daily fluctuations.

Emotional Control and Rational Decision-Making

Mastering Forex psychology requires a dual focus on emotional control and rational decision-making.

These elements are not only vital for sustained success in your trading career but also contribute significantly to your mental well-being.

Adopting a disciplined approach, divorced from day-to-day fluctuations, positions you for enduring success.

Remember, trading is a marathon, not a sprint.

By implementing these strategies, traders can mitigate the adverse effects of FOMO, ensuring a more measured and strategic approach to Forex trading.

Remember, it’s not just about the quantity of trades but the quality of decisions that propels you towards sustained success in the dynamic world of Forex.

Good Luck!

Is the UK GDP in Recession? How BOE is Responding to Inflation and Slowdown

Imagine yourself standing at the helm of a mighty ship, the UK economy. The once steady seas have become a…

How Forex Liquidity Providers Keep Markets Moving

Imagine a bustling marketplace buzzing with currency exchanges. Behind the scenes, silent heroes called Forex liquidity providers work tirelessly to…

Russell 2000 Technical Analysis

Yesterday, the Russell 2000 staged a strong rally, erasing all losses from the hot US CPI numbers. It appears the…

Statistics for Your Trade Magazine | Forex Tips for Analyzing Trades

In previous blogs, I emphasized the importance of recording transactions and highlighted the best journaling options. For new traders, efficient…

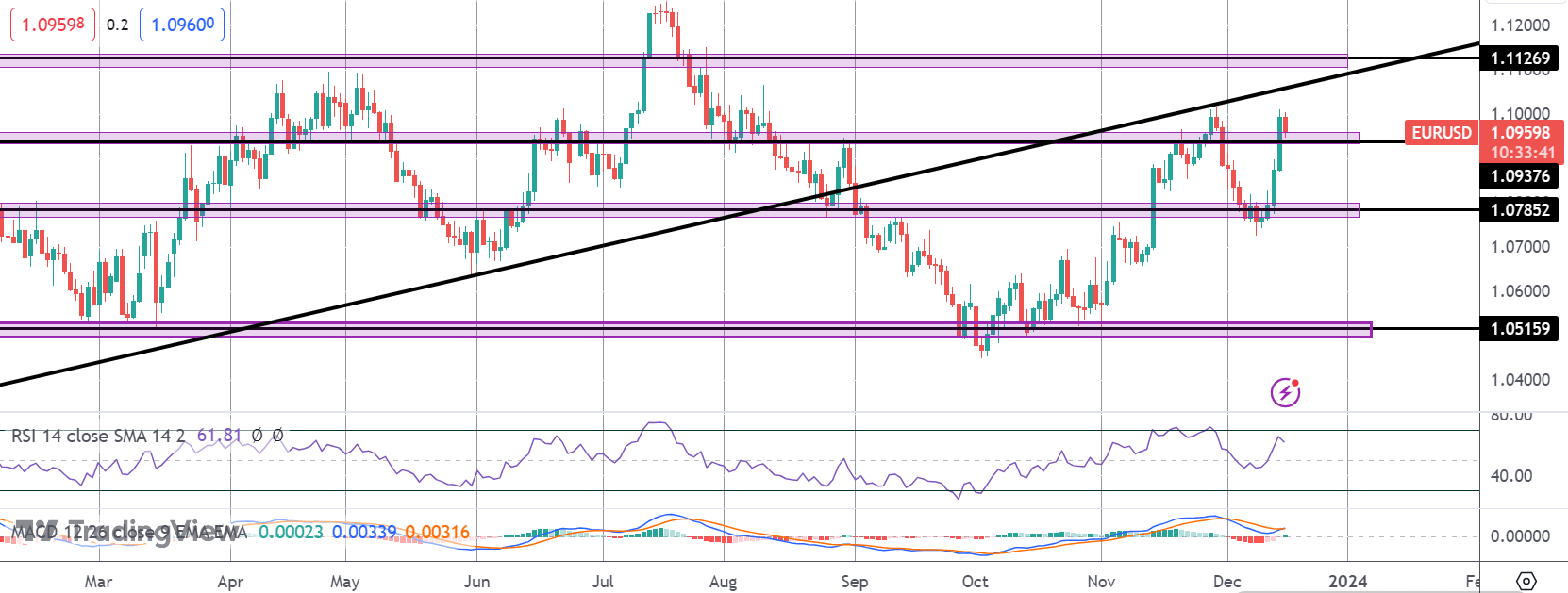

EURUSD Traders Caught Between Fed and ECB

EUR rally stalls Following the post-FOMC rally we saw on Wednesday, EURUSD was pushed further higher by the ECB yesterday. While…

Moderate Optimism, an Eye for Risks: Navigating the Financial Landscape in 2024

The dawn of a new year brings a mixed bag of challenges and opportunities. Despite renewed geopolitical tensions and wars,…