The dawn of a new year brings a mixed bag of challenges and opportunities.

Despite renewed geopolitical tensions and wars, there’s a sense of moderate optimism when we peer into the financial horizon.

In this article, we delve into the complexities of the financial world, exploring the delicate balance between hope and caution.

A Year of Flux: Geopolitics and Monetary Policy

The year begins with geopolitical tensions and monetary policy uncertainties. However, it’s crucial to note that this doesn’t necessarily breed pessimism.

As we review forecasts from major financial institutions, a nuanced sense of moderate optimism emerges.

The editor’s reflections on presentations reveal a landscape that requires a keen eye for risks.

Shifting Realities: Interest Rates and Growth Forecasts

In the ever-changing financial landscape, the new reality of high interest rates persists for many companies.

The anticipation of lower growth in key economies in 2024 adds another layer of complexity.

The cost of debt remains elevated for corporations and sovereign governments, with no clear timeline on when or how much this might change.

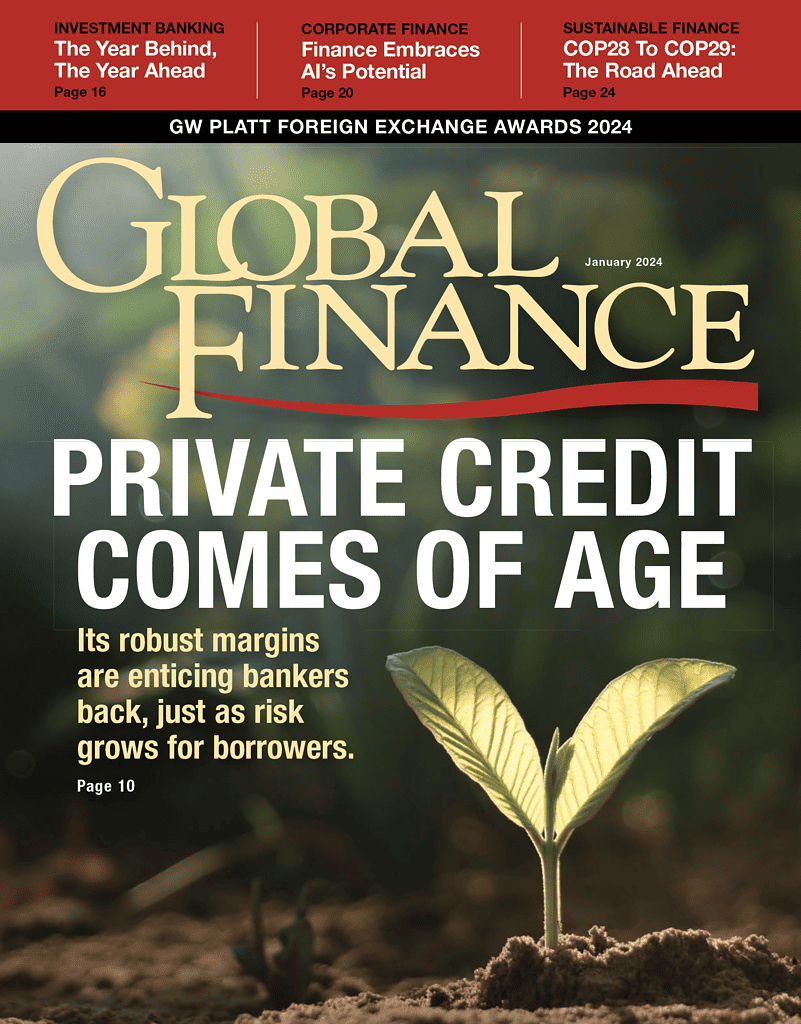

Retail Lending: Booming Sector with Growing Risks

Our cover story delves into the thriving sector of retail lending, capturing the attention of commercial banks.

This narrative focuses on the imminent and expanding risks to borrowers due to higher interest rates.

The ripple effect extends to the lenders who serve them, creating a delicate ecosystem that demands a strategic and cautious approach.

Niche Perspectives: AI in Finance and Oracle’s Vision

Two additional stories offer unique perspectives within the financial sector. Gilly Wright’s exploration of AI in Finance sheds light on technological advancements shaping the industry.

Our Salon with Sonny Singh, executive VP, and general manager at Oracle Financial Services, provides valuable insights into key growth areas and associated risks.

Technology, particularly AI, is showcased as a pivotal player in the financial landscape.

Annual Foreign Exchange Awards: Navigating Global Dynamics

Honoring the late Gordon Platt, our in-house expert, this issue features the annual Foreign Exchange Awards.

In a globalized world with ever-changing winds, trading solutions emerge as key players.

Technology, with its accuracy in dealing with currency fluctuations, has significantly enhanced the speed and capacity of executions.

Navigating the Dynamics: Moderating Optimism with Prudent Caution

As we navigate through these financial narratives, it’s essential to approach the future with moderate optimism tempered by an acute awareness of risks.

The dynamism of the sector demands adaptability and strategic planning.

Embracing technological advancements while understanding their associated risks positions individuals and entities for success in the evolving financial landscape.

FAQs

Q: How can moderate optimism coexist with geopolitical tensions and uncertainty?

A: Moderate optimism is rooted in a nuanced understanding of challenges and opportunities. It acknowledges the presence of uncertainties while seeking hope in strategic planning and adaptability.

Q: What factors contribute to the persistence of high interest rates for corporations and governments?

A: The cost of debt remains high due to various factors, including global economic conditions, inflationary pressures, and the anticipation of lower growth in key economies.

Q: How does retail lending pose risks to both borrowers and lenders?

A: Higher interest rates in the retail lending sector amplify risks for borrowers, creating a ripple effect on the lenders who serve them. Prudent risk management strategies become paramount in this scenario.

Q: What role does technology, especially AI, play in the financial sector’s growth areas?

A: Technology, particularly AI, is a key player in shaping growth areas within the financial sector. It enhances efficiency, accuracy, and capacity, while simultaneously introducing new risks that require careful navigation.

Q: How can individuals and entities adapt to the changing dynamics of the financial landscape?

A: Adaptability is key. Staying informed about technological advancements, understanding associated risks, and formulating strategic plans contribute to successful navigation in the evolving financial landscape.

Q: What significance do the Foreign Exchange Awards hold in a globalized financial world?

A: The Foreign Exchange Awards recognize excellence in navigating global dynamics. Trading solutions and technological advancements, highlighted by the awards, showcase key players’ contributions to the industry.

Conclusion

In the intricate dance of financial dynamics, moderate optimism serves as a compass, guiding individuals and entities through uncertain terrains.

Navigating the risks requires a delicate balance between embracing growth opportunities and understanding the potential pitfalls.

As we step into 2024, let this nuanced perspective be our guide, steering us toward a future where optimism meets prudence.

Is the UK GDP in Recession? How BOE is Responding to Inflation and Slowdown

Imagine yourself standing at the helm of a mighty ship, the UK economy. The once steady seas have become a…

How Forex Liquidity Providers Keep Markets Moving

Imagine a bustling marketplace buzzing with currency exchanges. Behind the scenes, silent heroes called Forex liquidity providers work tirelessly to…

Russell 2000 Technical Analysis

Yesterday, the Russell 2000 staged a strong rally, erasing all losses from the hot US CPI numbers. It appears the…

Statistics for Your Trade Magazine | Forex Tips for Analyzing Trades

In previous blogs, I emphasized the importance of recording transactions and highlighted the best journaling options. For new traders, efficient…

Never Miss a Good Trade | Forex Psychology

In the fast-paced realm of Forex trading, the Fear of Missing Out (FOMO) looms like a shadow, affecting not only…

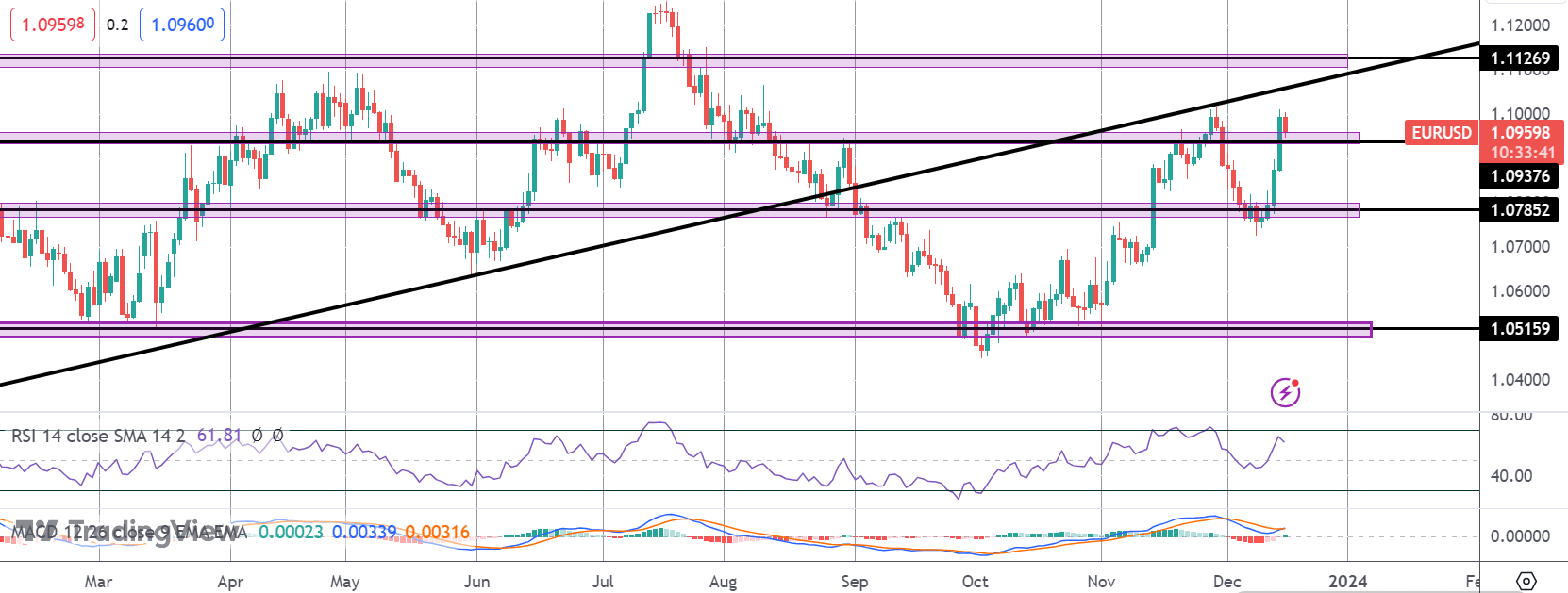

EURUSD Traders Caught Between Fed and ECB

EUR rally stalls Following the post-FOMC rally we saw on Wednesday, EURUSD was pushed further higher by the ECB yesterday. While…

I loved you better than you would ever be able to express here. The picture is beautiful, and your wording is elegant; nonetheless, you read it in a short amount of time. I believe that you ought to give it another shot in the near future. If you make sure that this trek is safe, I will most likely try to do that again and again.