EUR rally stalls

Following the post-FOMC rally we saw on Wednesday, EURUSD was pushed further higher by the ECB yesterday. While the bank kept rates unchanged and arguably made some mild adjustments to the decision statement, Lagarde’s opposition to rate cuts and her insistence that rates should remain at current levels for some time to come ultimately pushed the EURUSD higher, reinforced by the weakness of the USD.

ECB/Fed expectations

The pair is now stuck at November highs and traders are caught between ECB and Fed expectations. Ahead of the ECB meeting, traders had already fully priced in an ECB rate cut in April, fueled by dovish comments from ECB-Schnabel and the recent CPI decline. Ultimately, bears are likely to see yesterday’s comments from Lagarde as a means to prevent a downtrend in the EUR, which could feed back into higher inflation. Consequently, the focus will remain on growth risks in the eurozone and incoming data. Should the numbers continue to move lower, the EUR should move lower again as traders bring forward their interest rate cuts by the ECB. Moreover, any further dovish comments from the ECB will also weigh on the pair.

Technical views

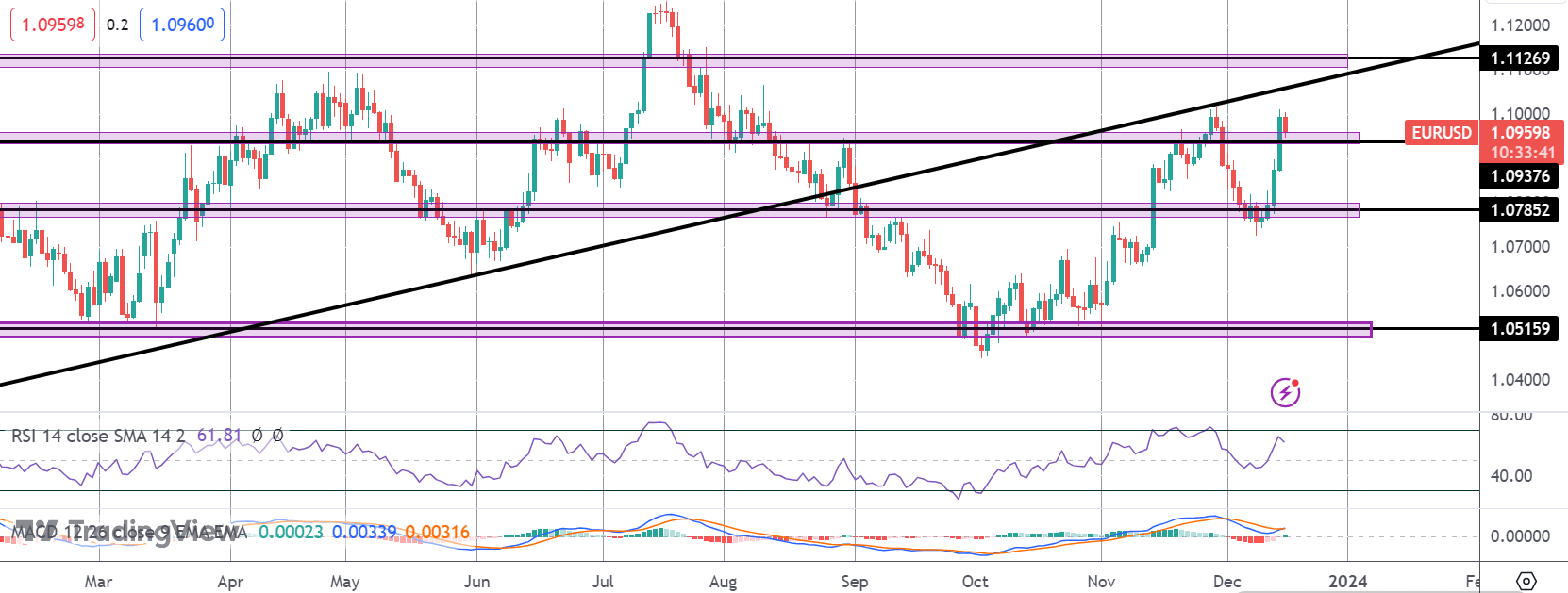

EURUSD

The rally in EURUSD has taken the market back above the 1.0937 level, but the rally has stalled for now at November highs of 1.10. The large bearish divergence in momentum studies increases the risks of a double top if we drop below 1.0937 again, bringing the focus back to 1.0785 support.

Is the UK GDP in Recession? How BOE is Responding to Inflation and Slowdown

Imagine yourself standing at the helm of a mighty ship, the UK economy. The once steady seas have become a…

How Forex Liquidity Providers Keep Markets Moving

Imagine a bustling marketplace buzzing with currency exchanges. Behind the scenes, silent heroes called Forex liquidity providers work tirelessly to…

Russell 2000 Technical Analysis

Yesterday, the Russell 2000 staged a strong rally, erasing all losses from the hot US CPI numbers. It appears the…

Statistics for Your Trade Magazine | Forex Tips for Analyzing Trades

In previous blogs, I emphasized the importance of recording transactions and highlighted the best journaling options. For new traders, efficient…

Never Miss a Good Trade | Forex Psychology

In the fast-paced realm of Forex trading, the Fear of Missing Out (FOMO) looms like a shadow, affecting not only…

Moderate Optimism, an Eye for Risks: Navigating the Financial Landscape in 2024

The dawn of a new year brings a mixed bag of challenges and opportunities. Despite renewed geopolitical tensions and wars,…