Imagine a bustling marketplace buzzing with currency exchanges. Behind the scenes, silent heroes called Forex liquidity providers work tirelessly to maintain market stability, enabling seamless trades for everyone involved.

Understanding Forex Liquidity Providers and Its Significance

The fast-paced world of Forex thrives on liquidity, the ease of buying or selling currencies without impacting prices drastically. This is paramount in OTC (over-the-counter) transactions, where trades occur directly between parties.

A liquid currency pair can be readily exchanged without causing market disruptions, meaning executed prices stay close to expected values. Here are some factors influencing Forex liquidity:

- Monetary Policy: Shifts in interest rates or inflation fluctuations can directly affect currency liquidity.

- Global Credit Dynamics: A country’s credit supply or demand can influence liquidity, often reflecting the health of the global financial market.

The extent of liquidity significantly impacts trading conditions and spreads. Higher liquidity generally translates to:

- Favorable Trading Conditions: Attracting more market participants.

- Stable Cryptocurrency Prices: Minimizing price swings.

- Healthy Global Economy: Enabling smooth international trade.

Unveiling the Role of Forex Liquidity Providers

Forex liquidity providers (LPs) are the unsung heroes, ensuring efficient currency conversions with minimal slippage (difference between expected and executed price). They achieve this by:

- Facilitating Large Transactions: Utilizing banking relationships and BaaS (Banking as a Service) partnerships to enable easy fiat (government-issued currency) on/off ramping.

The Diverse Landscape of Forex Liquidity Providers

The Forex market benefits from a variety of LPs, each playing a distinct role:

- Banks: Major players offering competitive prices due to vast asset holdings.

- Electronic Communication Networks (ECNs): Matching buy and sell orders, connecting traders for efficient transactions.

- Market Makers: Providing liquidity by actively trading from their inventories, fostering market stability during volatility.

- Hedge Funds: Significant contributors to liquidity due to their large-scale trading activities, similar to banks.

- Retail Brokers: Aggregating liquidity by connecting retail traders with prominent financial institutions.

Classifying Financial Assets for Liquidity

Liquidity providers hold financial assets categorized into tiers based on ease of conversion to cash:

- Tier 1: Representing an institution’s core financial strength, including key revenue streams and equity.

- Tier 2: Less liquid than Tier 1 assets, supplementing core holdings during market downturns.

- Tier 3: The least liquid category, phased out after the 2008 financial crisis due to high-risk profiles.

Advantages of Partnering with a Forex Liquidity Provider

Brokers reap numerous benefits by collaborating with reliable Forex liquidity providers:

- Deeper Liquidity Pools: Mitigating price fluctuations, especially during significant news announcements.

- Competitive Spreads and Pricing: High-quality asset holders offer better long-term value and competitive pricing structures.

- Enhanced Trade Execution Speed: Advanced technology facilitates rapid trade execution.

- Reduced Slippage: Transparent markets minimize the risk of slippage.

- Market Stability: LPs help prevent extreme volatility and sudden price crashes.

Selecting the Ideal Forex Liquidity Provider

Choosing the right Forex liquidity provider requires careful consideration of several factors:

- Asset Reliability: Providers with high-value assets inspire greater trust.

- Technological Infrastructure: Advanced technology ensures swift and efficient order processing.

- Transparent Price Structure: Look for clear and understandable pricing models.

- ECNs and STPs (Straight Through Processing): Understanding their role is crucial for eliminating conflicts of interest and upholding fair practices.

- Offer Comparison: Meticulously compare offers, paying close attention to hidden fees or conditions.

Legal and Regulatory Considerations

Staying informed about international regulations governing liquidity providers is essential. The global nature of Forex means regional regulations can significantly impact business operations. Partnering with compliant providers ensures legal security and protects clients from fiduciary risks.

The Future of Forex Liquidity

The Forex market is constantly evolving, and the role of liquidity providers is likely to adapt as well. Here are some potential future trends:

- Technological Advancements: Continued advancements in technology like artificial intelligence and machine learning could further streamline liquidity provision, potentially reducing human error and improving efficiency.

- Increased Regulation: Regulatory bodies might introduce stricter regulations to ensure transparency and safeguard market integrity.

- Focus on Decentralization: The rise of blockchain technology could lead to the emergence of decentralized liquidity solutions, potentially disrupting the traditional model.

Frequently Question Asked (FAQ)

Q: What are the risks associated with Forex liquidity providers?

While Forex liquidity providers offer numerous advantages, there are also potential risks to consider:

- Counterparty Risk: The possibility of a liquidity provider defaulting on its obligations. Partnering with well-established providers with a proven track record can mitigate this risk.

- Hidden Fees: Some LPs might have unclear fee structures or hidden charges. Thorough research and a keen eye for details are crucial when evaluating potential partners.

- Market Manipulation: In rare instances, unethical LPs might attempt to manipulate markets for personal gain. Choosing reputable providers with a strong commitment to fair practices helps minimize this risk.

Conclusion

Forex liquidity providers play a critical role in maintaining a healthy and efficient Forex market. By understanding their functions, benefits, and potential risks, brokers can make informed decisions when selecting partners. As the Forex market continues to evolve, the role of liquidity providers will undoubtedly adapt, leveraging technological advancements and navigating changing regulations.

Similar Topics

Is the UK GDP in Recession? How BOE is Responding to Inflation and Slowdown

Imagine yourself standing at the helm of a mighty ship, the UK economy. The once steady seas have become a…

Russell 2000 Technical Analysis

Yesterday, the Russell 2000 staged a strong rally, erasing all losses from the hot US CPI numbers. It appears the…

Statistics for Your Trade Magazine | Forex Tips for Analyzing Trades

In previous blogs, I emphasized the importance of recording transactions and highlighted the best journaling options. For new traders, efficient…

Never Miss a Good Trade | Forex Psychology

In the fast-paced realm of Forex trading, the Fear of Missing Out (FOMO) looms like a shadow, affecting not only…

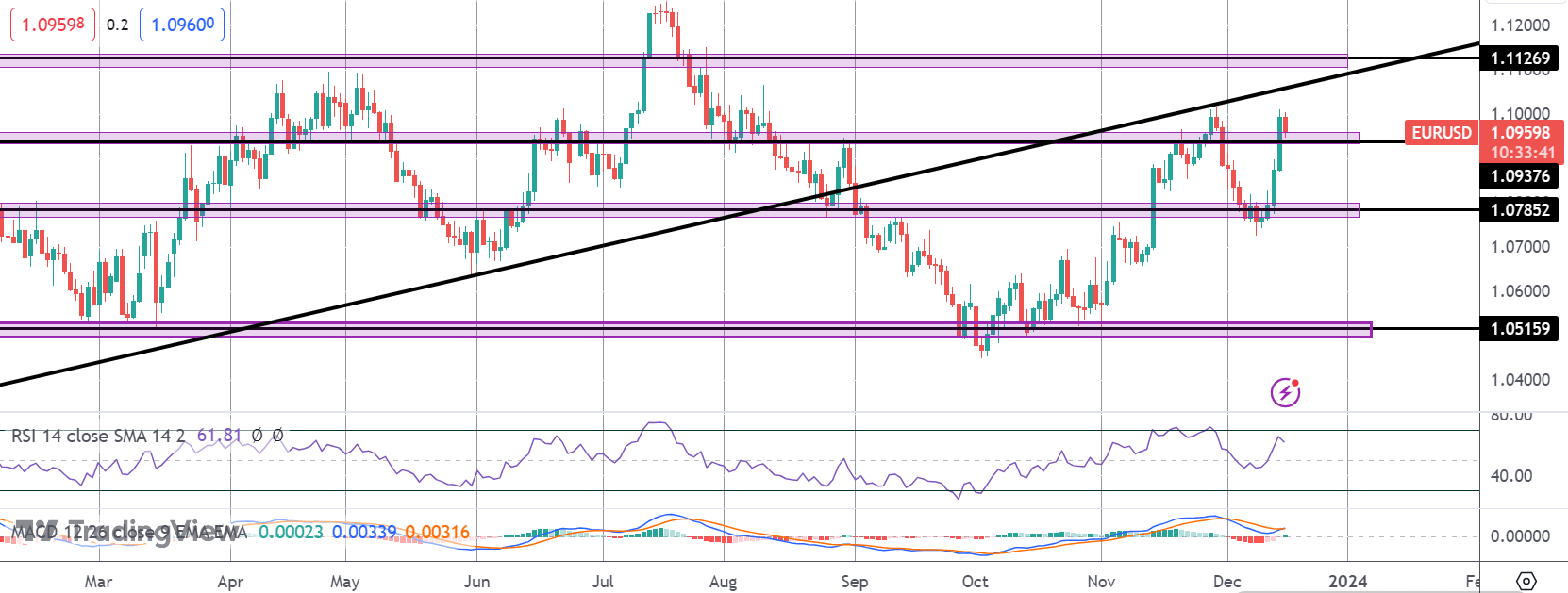

EURUSD Traders Caught Between Fed and ECB

EUR rally stalls Following the post-FOMC rally we saw on Wednesday, EURUSD was pushed further higher by the ECB yesterday. While…

Moderate Optimism, an Eye for Risks: Navigating the Financial Landscape in 2024

The dawn of a new year brings a mixed bag of challenges and opportunities. Despite renewed geopolitical tensions and wars,…