The US dollar, after reaching its peak, is facing headwinds as we approach the new year.

This article delves into the intricate factors contributing to the dollar’s struggles and explores the broader market dynamics.

Capital Flows: The Ebb and Flow Before the New Year

Capital flows play a pivotal role in shaping the financial landscape, especially in the transition to a new year.

As we countdown, the ebb and flow of capital become more pronounced, influencing the US dollar’s trajectory.

Understanding these dynamics is key to anticipating market movements.

Tax-Loss Stock Sales: Last-Minute Considerations

With tomorrow marking the final day for US tax-loss stock sales, investors are making critical decisions that reverberate through the market.

The impact of these sales on the US dollar cannot be understated, and delving into the nuances provides valuable insights for traders.

Global Interest Rate Cuts: A Paradigm Shift on the Horizon

Looking beyond domestic factors, the market is recalibrating towards anticipating more significant global interest rate cuts in the coming year.

The Fed Fund Futures projection of a 155 basis point rate cut signals a substantial shift, but the question remains: Have other markets fully embraced this level?

Low-Yielding Currencies Surge: USD/JPY and USD/CHF in Focus

The Japanese yen and the Swiss franc have emerged as strong players this week.

The USD/JPY hitting its lowest since July and the rise in USD/CHF demand closer scrutiny.

These movements signify a market conviction that interest rates will converge to lower levels.

Interest Rate Convergence: Navigating a Changing Landscape

The market increasingly believes that interest rates will converge to lower levels, with Fed funds possibly heading towards 2% and Japanese rates rising to 0.5%.

This is a notable departure from previous expectations, impacting the dynamics of currency trading.

Disappearing Dollar Longs: Unraveling a Puzzling Trend

Dollar longs have been a busy trade, but they are disappearing rapidly. This phenomenon raises questions about whether it’s a natural market evolution or a result of a short squeeze.

Investigating the factors behind vanishing dollar longs provides clarity on the market sentiment.

Bond Yields: Short Squeeze or Fundamental Shift?

The recent drop in government bond yields sparks curiosity—is it a short squeeze or a genuine reflection of fundamentals?

Distinguishing between these possibilities is crucial in understanding the underlying forces influencing the US dollar’s position.

Dollar Trading Dynamics: Navigating Size and Seasonality

Dollar trading operates on a unique timeline, influenced by the sheer size of the currency market and the time of year.

Unpacking the nuances of dollar trading provides context to observed trends and aids in foreseeing potential future movements.

Year-End Trading Challenges: Preparing for Market Volatility

As we approach the year-end trading day, traders face unique challenges stemming from tax considerations, portfolio adjustments, and shifting market sentiment.

Strategically navigating these challenges is essential for capitalizing on opportunities and managing risks effectively.

Prospects for New Year’s Day Trading: Anticipating Market Trends

New Year’s Day often ushers in a subdued trading environment.

Traders must anticipate this lull and adjust their strategies accordingly.

Understanding the factors contributing to this outlook is pivotal for making informed trading decisions.

US Dollar Struggles to Maintain Gains Despite Rising Interest Rates: FAQs

- What factors contribute to the US dollar’s struggles in maintaining gains?

The US dollar faces challenges due to year-end capital flows, last-day tax-loss stock sales, and a global shift towards anticipating significant interest rate cuts. - How do capital flows impact the US dollar’s trajectory?

Capital flows play a crucial role in shaping the dollar’s movement, with the transition to a new year intensifying the ebb and flow of funds. - Why are low-yielding currencies like the Japanese yen and Swiss franc gaining strength?

The market’s increasing conviction that interest rates will converge to lower levels is reflected in the strength of low-yielding currencies. - What is driving the disappearance of dollar longs?

Dollar longs are vanishing rapidly, raising questions about whether it’s a natural market evolution or a result of a short squeeze. - Is the drop in government bond yields a short squeeze or a fundamental shift?

Distinguishing between a short squeeze and a genuine fundamental shift is crucial in understanding the recent drop in government bond yields. - How does year-end trading impact the US dollar?

Year-end trading presents unique challenges related to tax considerations, portfolio adjustments, and shifting market sentiment, influencing the US dollar’s position.

Conclusion: Navigating Uncertainties in Currency Markets

In conclusion, the US dollar’s struggles despite rising interest rates are intertwined with a complex web of factors.

As we navigate the year-end challenges and look ahead to the new year, staying attuned to these dynamics will be key for traders and investors.

The market, characterized by disappearing dollar longs and nuanced trading dynamics, requires a strategic and informed approach for success.

Is the UK GDP in Recession? How BOE is Responding to Inflation and Slowdown

Imagine yourself standing at the helm of a mighty ship, the UK economy. The once steady seas have become a…

How Forex Liquidity Providers Keep Markets Moving

Imagine a bustling marketplace buzzing with currency exchanges. Behind the scenes, silent heroes called Forex liquidity providers work tirelessly to…

Russell 2000 Technical Analysis

Yesterday, the Russell 2000 staged a strong rally, erasing all losses from the hot US CPI numbers. It appears the…

Statistics for Your Trade Magazine | Forex Tips for Analyzing Trades

In previous blogs, I emphasized the importance of recording transactions and highlighted the best journaling options. For new traders, efficient…

Never Miss a Good Trade | Forex Psychology

In the fast-paced realm of Forex trading, the Fear of Missing Out (FOMO) looms like a shadow, affecting not only…

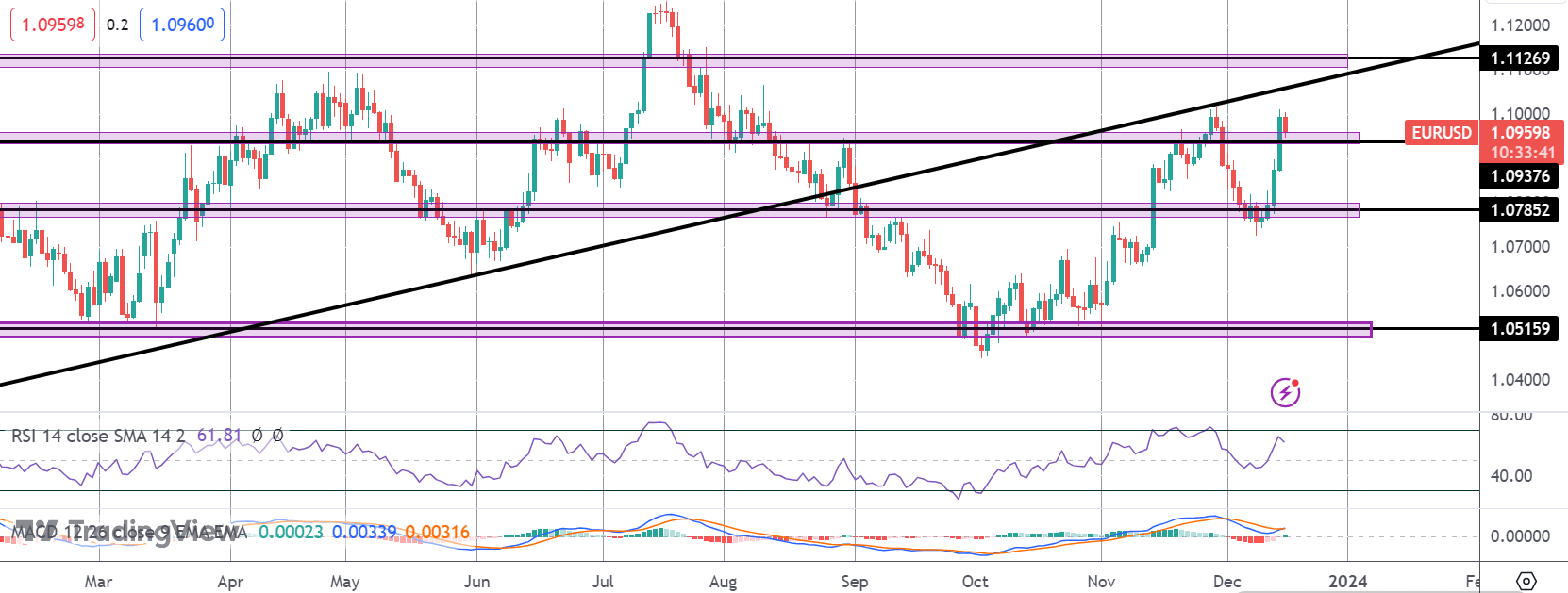

EURUSD Traders Caught Between Fed and ECB

EUR rally stalls Following the post-FOMC rally we saw on Wednesday, EURUSD was pushed further higher by the ECB yesterday. While…